Westhall is dedicated to sourcing, researching and raising capital for absolute return funds including hedge funds, long only funds and private equity funds. Westhall’s expertise typically focuses on Asia, Japan and, to a lesser extent, Emerging Markets and other global special situations.

Company History

Westhall Partners was founded by Doug Fulton and Robbie Hume in 2007, having initially been setup as a specialist independent fund division within Westhall Capital in 2004. Prior to this in 1999, Doug and Robbie assisted in establishing a similar business at CLSA, the Asian research & broking firm.

Westhall’s introduction services to US investors are conducted through our Registered Broker Dealer, Cresta Westhall LLP, which was set up as a joint venture and is an authorised member of FINRA.

With a long standing team experienced in researching and introducing successful alpha generating absolute return long only, hedged and private equity funds to a discerning institutional investor base, Westhall will continue to strive to partner and source the best investment managers dedicated to Asia, Emerging Markets and special situations.

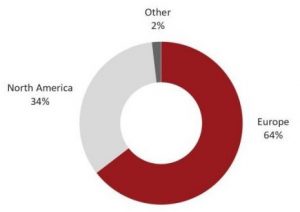

Access to a global institutional investor base with particular strengths in North America and Europe.

Philosophy

We are dedicated to working alongside Asia Pacific’s best investment managers. We work according to a fund manager’s goals and wishes whether it be a concerted marketing effort or a rifle-shot approach.

As placement agent, we seek a long-term mutually beneficial relationship with an investment manager by working to their goals.

Our deep knowledge of the Asia Pacific fund manager industry positions us in a privileged role of assisting investors with their search for investment expertise in the region. We seek to build on the trust and reputation we have developed with investors over many years to act as an additional screen on their investment selection process.

We have a prompt and efficient culture which is helped by hard work.

Track Record

Raised approx. $3 billion for boutique Asian managers.

Our strengths are North America and Europe.